As the global carbon market expands, one of the key challenges it faces is the lack of interoperability between carbon trading systems in different countries. Carbon credits from one jurisdiction may not be easily recognized in another, leading to inefficiencies, delays, and increased costs in cross-border carbon credit trading. For the carbon market to truly support global efforts in mitigating climate change, there needs to be a more seamless way to trade credits across borders.

Blockchain technology offers an ideal solution for overcoming these challenges. By providing a transparent, decentralized, and interoperable platform, blockchain can facilitate cross-border carbon credit trading, allowing carbon credits from different jurisdictions to be verified, traded, and tracked more efficiently. In this article, we’ll explore how blockchain can simplify global carbon credit trading and the benefits it brings to market participants.

The Challenge of Cross-Border Carbon Credit Trading

Carbon credit trading is often hampered by the fragmentation of markets across borders. Each country or region typically has its own set of standards, regulatory frameworks, and verification processes. Some of the major challenges include:

• Incompatibility of Carbon Credits: Carbon credits issued in one country may not meet the standards or regulations of another country, making it difficult to trade credits across borders.

• Lack of Trust and Transparency: Without a common system for verifying carbon credits, there is often a lack of transparency and trust between buyers and sellers in different regions.

• Delays and Costs: Transferring carbon credits between countries can be a lengthy process, involving multiple intermediaries, which drives up transaction costs and slows down trading.

These challenges limit the effectiveness of the global carbon market, preventing it from reaching its full potential in helping to reduce global emissions.

How Blockchain Facilitates Cross-Border Carbon Credit Trading

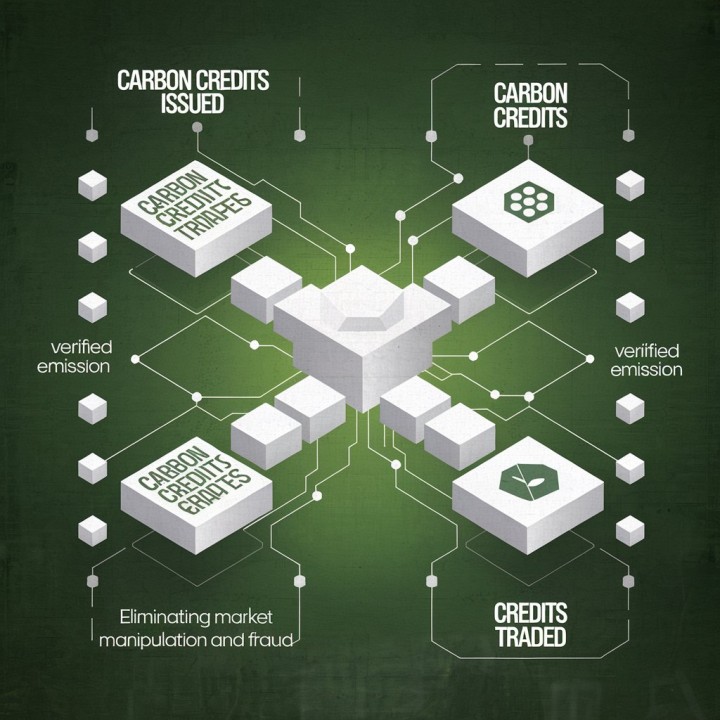

Blockchain’s decentralized and transparent nature offers a way to overcome these cross-border trading challenges by creating a common framework for carbon credit verification, issuance, and trading. Here’s how blockchain can help:

1. Interoperability Across Jurisdictions

One of the biggest benefits of blockchain is its ability to provide interoperability across different systems. Blockchain enables the creation of a common standard for carbon credits, allowing credits from different countries to be tokenized and traded on a shared, global ledger. This means that carbon credits issued in one country can be recognized and traded in another without the need for manual reconciliation or complex cross-border agreements.

2. Enhanced Transparency and Trust

Blockchain provides a tamper-proof, immutable record of every carbon credit transaction, from issuance to retirement. This level of transparency builds trust between buyers and sellers, ensuring that credits being traded across borders are legitimate and verified. With blockchain, all parties can track the history of a carbon credit, ensuring that it has not been double-counted or fraudulently altered.

3. Real-Time Settlements

Traditional cross-border carbon credit trading can be slow, often taking days or weeks to settle transactions. Blockchain enables real-time trading and settlement, allowing carbon credits to be transferred instantly between countries. This reduces the delays and costs associated with intermediaries, making the global carbon market more efficient.

4. Cost Reduction

By eliminating the need for intermediaries such as brokers and registries, blockchain significantly reduces the costs associated with cross-border carbon credit trading. This is particularly beneficial for smaller organizations or countries with less-developed carbon markets, as it makes participation in the global carbon market more accessible and affordable.

Real-World Examples of Blockchain in Cross-Border Carbon Credit Trading

Several blockchain-based platforms are already paving the way for seamless cross-border carbon credit trading:

• Carbonplace: This platform, developed by a consortium of global banks, uses blockchain to facilitate the transfer of carbon credits between countries. Carbonplace provides a secure, decentralized platform where companies can buy and sell carbon credits in real time, across borders.

• Toucan Protocol: Built on the Polygon blockchain, Toucan tokenizes carbon credits, enabling them to be traded on decentralized exchanges. This allows for easy cross-border trading of tokenized carbon credits, reducing the friction traditionally associated with international carbon trading.

• World Bank Blockchain Lab: In Chile, the World Bank has tested a blockchain platform to manage cross-border carbon credit trading. The platform automates the process of reporting and verifying carbon credits, ensuring that transactions are transparent and compliant with international standards.

These projects demonstrate how blockchain is already being used to simplify cross-border carbon credit trading, enhancing both the efficiency and transparency of the global carbon market.

How Baliola’s Mandala Application Chain Can Help

For businesses and governments looking to participate in cross-border carbon credit trading, Baliola’s Mandala Application Chain offers a powerful solution. As a blockchain-as-a-service (BaaS) platform, Mandala Application Chain allows organizations to build customized blockchain systems that support seamless cross-border trading of carbon credits.

With Mandala Application Chain, organizations can:

• Ensure interoperability between different carbon trading systems, allowing carbon credits to be tokenized and traded across borders without friction.

• Enhance trust and transparency by providing a tamper-proof, decentralized ledger where all carbon credit transactions can be verified and tracked in real time.

• Reduce transaction costs by eliminating the need for intermediaries, making it more affordable to participate in global carbon credit trading.

• Settle transactions instantly with real-time trading and settlement, enabling faster, more efficient transfers of carbon credits across borders.

By adopting Mandala Application Chain, organizations can gain a competitive edge in the global carbon market, streamlining cross-border transactions and ensuring compliance with international standards.

Ready to Simplify Cross-Border Carbon Credit Trading?

If your organization is looking to participate in the global carbon market and wants a streamlined, transparent, and cost-effective solution for cross-border carbon credit trading, Baliola can help. Mandala Application Chain offers a customizable platform that ensures seamless interoperability and real-time trading across jurisdictions. Contact Baliola today to learn more about how we can support your carbon market initiatives.